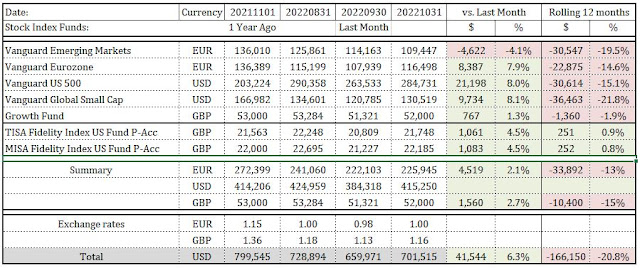

↓ Emerging Markets Stock Index Fund is down by $4,622 or -4.1%

Grand total losses: $4,622 USD

↑ Eurozone Stock Index Fund is up by $8,387 or 7.9%

↑ US 500 Stock Index Fund is up by $21,198 or 8.0%

↑ Global Small Cap Index is up by $9,734 or 8.1%

↑ Growth fund is up 767 or 1.3%

↑ EUR is up to USD by 2.1%, so for my portfolio its $4,519

↑ GBP is down to USD by 2.7%, so for my portfolio its $1,560

Grand total gains: $46,166 USD

Observations: The markets are still highly volatile. They have recovered somewhat 6.3% from prior month but still 20.8% down from the year before.

It is good to be a realist. Back in August 2008 I estimated that by August 2020 my portfolio in 2008 money would be $498 K in 2008 money. It is actually $522K. Of course, there some expenses along the way - we bought a house (15 years left on the mortgage) – I could easily add another $200 K to the nest egg.

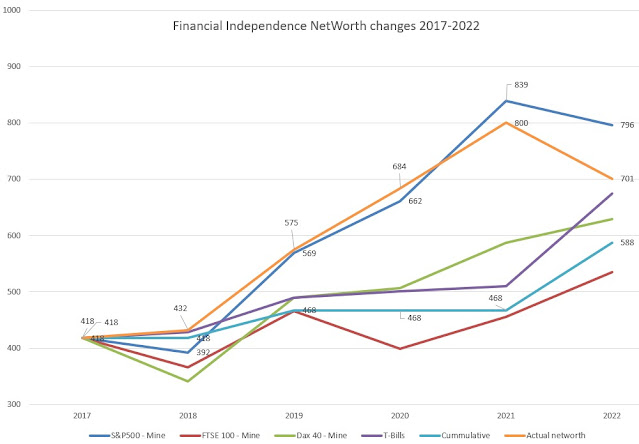

I like to hold a mirror and do bench-marking. I did comparison of my investments using five metrics: S&P500, FTSE100, Dax40, investing in inflation protected T-bills or simply put the money in a bank at a zero interest.

Here is how financial independence nest egg performed between 2008 to 2022:

As you can see even keeping the money under the mattress would be a better strategy. I would have $800K by now.

There had been three distinct periods in my investing.

- 2008 – 2012. Rambling – I was investing in high commission mutual funds, precious metals and generally was keeping money in a savings account.

- 2012-2017 Active investment in individual stocks and Vanguard and iShares ETFs. It was a bad idea, as $100 invested in S&P500 in 2012 would become $212 in 2017 or $314 today.

- 2017-2022 Diversified focus on emerging markets, eurozone. S&P500 and small cap stocks. I paid quite a lot for the diversification and exposure to EUR. $100 invested in 2017 in S&P500 would be $172 today. While $109 in Eurozone are $116 five years later.

Thank you to my ex-bank which forced me to sell all my investments, the things improved. I am still almost $100K below S&P500 (or 14%) but above all other metrics. I also learnt the lesson and topped up S&P500 with $120K earlier this year.

What is also quite curious – there is a lot of hype about British FTSE 100, German Dax40 and so on. My simple analysis shows that Eurozone economies and the UK are significantly under perform the S&P500 power train.

What is more worrying that my current nest egg very close to T-bills alternative. What it means that in high inflation environment my adjusted returns are close to zero.

Life is stranger than a fiction. This is all written from a lounge at an airport in Saudi Arabia. I am eternally grateful for this opportunity to accumulate even those modest amounts of money and the lessons given. Hopefully you will find it useful on your road to financial independence.

No comments:

Post a Comment