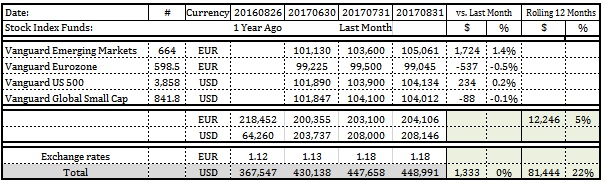

↑ Emerging Markets Stock Index Fund is up by

2,4% or $1,724

↑ US 500 Stock Index Fund is up by 0.2% or

$234

Grand

total additions: $1,958

↓ Eurozone Stock Index Fund is down by 0.5%

or $537

↓

Global Small Cap Index is down

by 0.1% or $88

Total

loss: $625

Observations:

-

Emerging

markets has been the leading investment so far in 2017, with Eurozone shares

lost almost 1% for the last 3 months. EU is still can not ascertain what to do without strong US leadership and steer how to live.

-

I feel

quite relieved with the amount of workload reduced, due to the investment

consolidation. I call this approach a

“zero based”, i.e. starting from what is essential, decluttering

or removing the rest. Over the period of

life time we accumulate different habits, routines which take up considerable

time, money and effort without bringing a lot of benefits. This is time to

de-clutter the life.

-

If my next egg continues to perform at 3% a year above

inflation in 40 years, by the time I need to retire I will have $1 mln,

generating $30K a year. Its not a lot

but better than most pensions. This assume I will do not additional

contributions but also that I do not spend it all. This is not a financial

independence I wanted by any stretch of imagination but I have 40 years to

correct it.

No comments:

Post a Comment