↑ Financial independence savings for last month $2,000

↑ Emerging Markets Stock Index Fund is up by $4,585 or +2.8%

↑ Eurozone Stock Index Fund is up by $3,852 or +2.5%

↑ US 500 Stock Index Fund is up by $5,786 or +3.0%

↑ Global Small Cap Index is down by $1,888 or +2.7%

Grand total additions: $22,010 USD

Wednesday, September 1, 2021

August 2021 update ($800,283 +$22,010 or +%2.8)

Sunday, August 1, 2021

July 2021 update ($778,273 -$2,989 or -%0.4)

↑ Financial independence savings for last month $2,000

↑ Eurozone Stock Index Fund is up by $2,011 or +1.3%

↑ US 500 Stock Index Fund is up by $4,417 or +2.3%

↑GBP is up to USD by $1,024 or +1.5% for my portfolio

Grand total additions: $9,452 USD

↓ Emerging Markets Stock Index Fund is down by $11,300 or -6.7%

↓ Global Small Cap Index is down by $1,141 or -0.7%

Grand total loses: $12,441 USD

Thursday, July 1, 2021

June 2021 update ($781,262 +$2,737 or +%0.4)

↑ Financial independence savings for last month $2,000

↑ Emerging Markets Stock Index Fund is up by $5,573 or +3.3%

↑ Eurozone Stock Index Fund is up by $1,723 or +1.1%

↑ US 500 Stock Index Fund is up by $4,245 or +2.3%

↑ Global Small Cap Index is up by $325 or +0.2%

↑ Growth fund is up by $2,377 or +3.4%

Grand total additions: $16,243 USD

↓EUR is down to USD by $10,946 or -3.4% for my portfolio

↓GBP is down to USD by $2,560 or -3.7% for my portfolio

Grand total loses: $13,506 USD

Tuesday, June 1, 2021

May 2021 update ($778,526 +$17,398 or +%2.3)

↑ Financial independence savings for last month $2,000

↑ Emerging Markets Stock Index Fund is up by $1,501 or +0.9%

↑ Eurozone Stock Index Fund is up by $4,078 or +2.7%

↑ US 500 Stock Index Fund is up by $1,233 or +0.7%

↑ Global Small Cap Index is up by $1,631 or +1.0%

↑ Growth fund is up by $116 or +0.2%

↑ EUR is up to USD by $5,354 or +1.7% for my portfolio

↑ GBP is up to USD by $1,485 or +2.1% for my portfolio

Grand total additions: $17,398 USD

Monday, May 3, 2021

April 2021 update ($761,128 +$33,824 or +%4.7)

↑ Financial independence savings for last month $2,000

↑ Emerging Markets Stock Index Fund is up by $777 or +0.5%

↑ Eurozone Stock Index Fund is down by $3,498 or +2.4%

↑ US 500 Stock Index Fund is up by $10,031 or +5.8%

↑ Global Small Cap Index is up by $6,286 or +4.0%

↑ Growth fund is up by $2,353 or +3.6%

↑ EUR is up to USD by $7,891 or +2.6% for my portfolio

↑ GBP is up to USD by $989 or +1.5% for my portfolio

Wednesday, April 7, 2021

March 2021 update ($727,304 +$17,677 or +%2.5)

Friday, March 12, 2021

February 2021 update ($709,783 +$14,076 or +%2.0)

↑ Financial independence savings for last month $2,000

↑ Emerging Markets Stock Index Fund is up by $1,373 or +0.8%

↑ Eurozone Stock Index Fund is down by $4,404 or +3.3%

↑ US 500 Stock Index Fund is up by $1,207 or +0.7%

↑ Global Small Cap Index is up by $7,438 or +5.1%

Grand total additions: $16,423 USD

↓ EUR is down to USD by $2,456 or -0.8% for my portfolio

Total losses: $2,456

Friday, February 26, 2021

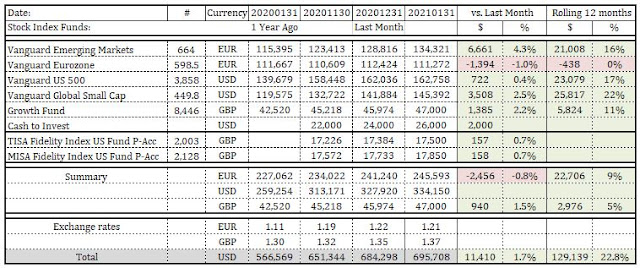

January 2021 update ($695,708 +$11,410 or +%1.7)

↑ Emerging Markets Stock Index Fund is up by $6,661 or +4.3%

↑ US 500 Stock Index Fund is up by $722 or +0.4%

↑ Global Small Cap Index is up by $3,508 or +2.5%

↑ Fidelity Growth Fund is up by $1,385 or +2.2%

↑ GBP is up to USD by $940 or 1.5% for my portfolio

Grand total additions: $15,216 USD

↓ Eurozone Stock Index Fund is down by $1,394 or -1.0%

↓ EUR is down to USD by $2,456 or -0.8% for my portfolio

Total losses: $3,850

Thursday, January 7, 2021

2021 Financial Independence Goals

So how can I make my goals achievable? I think that I need to scale back. If I can do more -great.

Financial goals:

a. Save 20% on the income - Accumulate $25 K a year.

b. Chose where to invest it and when.

Blog:

a. Regular monthly updates.

b. To cover 6 themes on financial independence.

Educational:

a. Read 3 books from the list.

b. Publish the books reviews.

c. Corporate finances to study in detail.

- Be happy. Run 600 miles during the year. BMI at 26.3 by December. Loose 2.5 pounds a month.

What are your 2021 goals? Is it something you recommend I do more or stop doing?

Sunday, January 3, 2021

2020 Financial Independence Goals review

This extraordinary year came to the end. My portfolio went up by 15%.

Financial goals:

- Save 20% on the income - Accumulate $25 K a year and invest it either in one of the existing funds or new one. – This goal is only partially complete. I accumulated $24 K but not invested. The markets are all time high, so it is no point to invest it now. I have not selected where I want to invest them.

Portfolio:

- Develop additional income source in full, potential reward about $2,000 a year. Target sites to be developed in full this year. This is “make it or break it”. If I am not able to do this year, I will wind down niche sites and focus elsewhere. My personal preference is to make it, despite disproportionate amount of time I might spent. – This did not happen. The main financial independence site generated some income. However, combined niche sites did not reach $2K a year. I need to re-focus the time elsewhere.

Blog:

- Regular monthly updates. – This complete.

- To cover 6 themes on financial independence, including mortgage one. – This goal is complete. Networth change past 10 years, Mutual funds spreading, The rich vs. Poor, Junior ISA, Market Charges, Dividend Aristocrats, Four percent rule.

Educational:

- Read 12 books from the list. – Read only two. One of them is Enough by John Bogle.

- Publish the books reviews. – Complete for the books that I read.

- Corporate finances to study in detail. – This did not occur.

- Be happy. Run 1,000 miles during the year. BMI at 26.3 by December. Loose 2.5 pounds a month. – Ran only 240 miles. I thought that last year with 253 miles the lowest possible one.

What are your 2020 goals? Is it something you recommend I do more or stop doing?

I need to think how to make this year goals smarter and to make

sure that I will complete them. How was your year and the goals achievements?

Friday, January 1, 2021

December 2020 update ($684,298 +$32,954 or +%5.1)