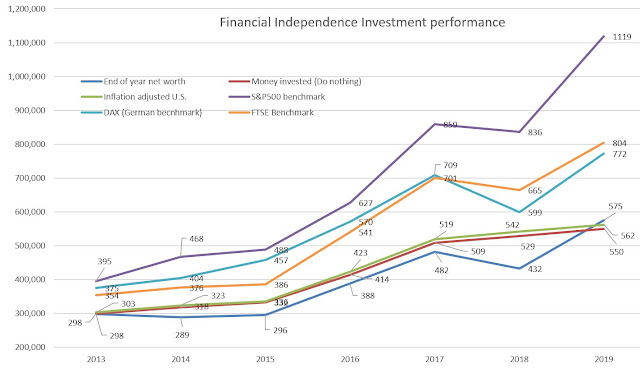

This is how my financial performance looked like over the course of the

last 6 years and benchmarking my investment decisions against global stock

markets:

|

Year

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|

End of the Year, $ K USD

|

298,429

|

288,608

|

295,536

|

387,831

|

482,266

|

432,089

|

575,086

|

|

Money invested (Do nothing)

|

298,429

|

318,105

|

332,356

|

413,899

|

508,617

|

528,940

|

549,690

|

|

Inflation adjusted U.S.*

|

394,553

|

361,145

|

336,942

|

462,739

|

619,649

|

501,911

|

722,293

|

|

S&P 500 benchmark**

|

394,553

|

467,612

|

488,316

|

627,481

|

859,178

|

835,597

|

1,118,724

|

|

DAX (Germany)**

|

374,528

|

404,317

|

457,382

|

570,485

|

708,560

|

599,216

|

772,167

|

|

FTSE (the UK)**

|

354,235

|

376,391

|

385,749

|

540,970

|

700,605

|

664,879

|

804,044

|

* If I

invested in inflation protected US treasury bills

** Total return (market change and dividends reinvestment)

As it could be seen from the graph if I would keep all money in cash, I

would have $550 K by now or $1,119 K if all invested in S&P500 (including

dividends reinvestment) for the past 7 years.

There are three main reasons for it:

-

As we understood earlier, that my previous focus

was on high return low growth stocks with aim of achieving earlier financial

independence. This has changed in 2017.

-

My portfolio is balanced among emerging markets,

European stock markets and S&P500.

British and German stock markets are shadowing S&P500 but

significantly lagging in performance.

-

I have significant exposure to EUR and used to have

some to British pound, over the last 7 years, EUR lost 19% to USD and British

pound 25%.

Going forward:

My current net worth is $575 K USD, if I assume that the historical stock

market growth is 7% and inflation is about 3%, expenses are 1% this will leave

net growth of 3%, a year.

This is an optimistic assumption, as the past decade market has been

more volatile mainly due to the power shift and share to the emerging markets.

EU specifically allows its luxury of politicking, instead of forging strong

unions and focus on economy.

If I leave the money without any additional investment, I should have $1,168

K in 25 years. This is approximately $46K

a year during retirement.

Currently I am able to save additional $10K a year this will result in

additional $375 K, bringing total to $1,574 K in today’s money, or $63K a year.

Our current expenses are about $110 K a year, without mortgage and kids

we need around $60K a year or approximately $ 2 million as nest egg (including

contingencies). To have $2 million in

retirement I need to save $23 K a year for the next 25 years. To retire early by 5 years, I need to save $35K

a year over the next 20 years. There is a huge incentive to save the additional

money towards the retirement.

Every little helps, but as you can see saving $100 a month over 25

years is going to give you $43 K in the next egg, doing the same for 40 years,

will result in $90K.

No comments:

Post a Comment