- Its turn out that USA GDP includes so-called imputed income, such as the assumed value of income from living in our own homes, the benefits of free checking accounts, and the value of employer paid insurance premiums. Such phantom income accounts for fully $3 trillion of 21 trillion GDP (2020).

- The Bureau of Labor Statistics proudly report that 2019 unemployment rate was relatively low at 3.6 percent (blacks at 5.4 and whites at 3.2). But the number of unemployed excludes workers too discouraged to look for a job, part-time workers looking for full-time jobs and those who are living on Social Security disability benefits. If we include these unemployed souls, the unemployment rate nearly doubles to 7.0 percent.

- Consumer price index. The concept of product substitution also was incorporated, meaning essentially that if top-grade hamburger gets too expensive, we substitute a cheaper grade. And (this is really true!) we don’t count cost increases that are attributable to increased quality. That is if, if airfares double but air travel service is deemed twice as efficient, the calculated cost of air travel is unchanged.

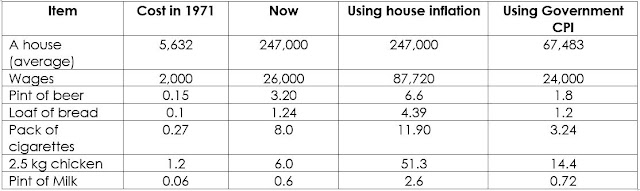

Here is funny example of using the UK “official” CPI:

This is reason why I keep my own family budget and expenses over the past ten years - to get independent notion what the inflation is like.

The government lies and misleads the law-abiding citizens at every opportunity, twisting the numbers to suit political agenda, while keeping the people poor. So, what is the reason for housing crisis in the UK? People don’t have enough money to buy them and arbitrary building restrictions.

The aggregate profits of corporations are closely linked, almost in lockstep with the growth of the economy. In a dog-eat-dog capitalistic economy where the competition is vigorous and largely unfettered and where the consumer is king, how could the profits of corporate America possibly grow faster than GDP?

Generally Accepted Accounting Principles (GAAP) and auditor-certified earnings have come under doubt. The number of corporate restatements has soared from 90 in 1997 to 484 in 2019. This is over five fold increase.

Loose accounting standards (i.e. loose counting) have made it possible to create, out of thin air, what passes for earnings. One popular method is acquiring and then taking giant charges described as nonrecurring, only to be reversed in later years when needed to bolster sagging operating results. But the breakdown in GAAP goes far beyond that: classifying large items as immaterial, hyping the assumed future returns of pension plans, counting as sales those made to customers who borrowed the money from the seller to make the purchase…creative accounting!

Our financial system has, in substance, challenged our corporations to produce earnings growth that is, in truth, unsustainable. When corporations fail to meet their numeric targets the hard way – over the long term, by raising productivity, by improving old products and creating new ones; by providing services on a more friendly, more timely, and more efficient basis; and by challenging the people of the organization to work more effectively together (and those are the ways that our best corporations achieve success) – they are compelled to do it in other ways that often subtract value from you, from me, and from society.

Measure not an objective. Our corporate strategy arose from a conviction that the best corporate growth comes from putting the horse of doing things for clients ahead of the cart of earning targets. Growth must be organic, rather than forced. … Lets keep our company a place where judgement has at least a fighting chance to triumph over process.

Daniel Yankelovich, who used psychology and sociology to bring a human dimension to his poll findings said: “.. The first step is to measure what can be easily measured. This is okay, as far as it goes.

The second step is to disregard that which can't be easily measured or to give it an arbitrary quantitative value. This is artificial and misleading.

The third step is to presume that what can't be measured easily really isn't important. This is blindness.

The fourth step is to say that what can't be easily measured really doesn't exist. This is suicide.”

Professional Conduct

Six common characteristics:1. A commitment to the interest of clients, and the welfare of society in general.

2. A body of theory or specialized knowledge

3. A specialized set of professional skills, practices and performances unique to the profession.

4. The developed capacity to render judgements with integrity under conditions of ethical uncertainty.

5. An organized approach to leaning from experience, both individually and collectively, and thus of growing new knowledge from the context of practice.

6. The development of a professional community responsible for the oversight and monitoring of quality in both practice and professional educators.

As we learned earlier, money management extracts value from the returns earned by our business enterprises, and in the process of maximizing its own commercial interests the industry seems to have lost its professional bearings. This definition of the financial industry reminds me character “Alan” from series “Two and a Half Man”, the leech.

Ownership and CEO compensation -> Performance, not peer groups

Direct ownership of U.S. stocks by individual investors has plummeted from 92 in 1950 percent to 22 percent now, while institutional investors has soared from 8 percent to 74 percent. The significant contributor is wash out of the middle classes and make low class even poorer.

Just forty years ago, the compensation of the average chief executive officer was forty-two time that of the average worker. In 2019 the ratio soared to 278 times of the average worker (down from 531 times at the peak in 2000).

Measured in real dollars, however, the compensation of the average worker rose just 0.3 percent per year, barely enough to maintain his or her standard of living. Yet CEO compensation rose at rate of 8.5 percent annually. The rationale was that these executives had “created wealth” for their shareholders. But were CEOs actually creating value commensurate with the huge increase in compensation? Certainly, the average CEO was not. In real terms aggregate corporate profits grew at an annual rate of just 2.9 percent, compared with 3.1 percent for our nation’s economy, as represented by the Gross Domestic Product”.

CEO’, however, are paid by directors not out of their own pockets but with other people’s money, a clear example of the agency problem in our investment system, and our focus on business conduct rather than professional conduct.

Consultancy is extremely popular among CEOs and the big companies. It takes away guessing and creates alignment among the peers. The same happening with the CEOs compensation. As you can guess a consultant how recommends lower pay or tougher standards for CEO compensation is not going to last long.

So, the quartiles scheme was invented, having designed in a ratchet effect. The board of directors finds that its own CEO’s pay is in fourth quartile, they are raising it to bring it, let say, to second quartile. This, inevitably, drops another CEO into fourth quartile. And, so the cycle repeats, onward and upward for years, almost always with the encouragement of the ostensibly impartial consultant. The consult makes the living by recommending more, not less.

Until CEOs are paid based on corporate performance rather than based on corporate peers, CEO pay will, almost inevitably, continue its upward path.

Actively managed funds

You have read everywhere that actively managed funds typically charge to much, leading to its clients losing money over passive fund. What is curious is that in 1951 average active fund was charging 0.77 percent, while in 2020 its 1.5 percent. Even on weighted by fund assets the expense ration went from 0.6 percent to 0.99 percent in 2020. Still staggering increase of more than 50 percent despite the perceived gains in productivity. The greed took over. Let’s look from different point of view equity fund assets were worth $2 billion in 1951 and $21 trillion in 2019. The industry that once provided its service (more effectively) for $12 million a year, now does so (less effectively) for $210 billion a year. Good for the managers and bad for the shareholders.

Too much management and not enough leadership

The manager administers; the leader innovates.The manager is a copy; the leader is an original.

The manager focuses on systems and structure; the leader focuses on people.

The manager relies on control; the leader inspires trust.

The manager has a short-range view; the leader has a long-ranger perspective.

The manager has his or her eye always on the bottom line; the leader has his or her eye on the horizon.

The manager initiates; the leader originates.

The manager accepts the status quo; the leader challenges it.

The manager does thing right; the leader does the right thing.

An insight into Vanguard payment structure: each crew member holds a specific number of partnership units, which we increase with years of service and job grade level, and each June receives a check that, with some significant exceptions, typically comes to 30 percent of a crew member’s annual compensation.

This reminds me of an enhanced sailors’ compensation in old days. Sailors did not have salary but participated in the profit sharing on its return home. This had the risks, as if no profits there was no salary and they had to borrow to feed their families.

Commitment and boldness – these are among the things that truly matter, the things by which we can measure our lives, the things that help turn providence in our favor. Their reach goes far beyond how we earn our living, for never forget than none of us lives by bread alone.

Too much “success”, not enough character.

There was an old greyhound, just like the ones who race around a track chasing those mechanical rabbits. A girl took the dog in to prevent it from being destroyed because its racing days were over. There was a conversation struck up with the greyhound:

I said to the dog, “Are you still racing?”

“No”, he replied.

“Well, what was the matter? Did you get too old to race?”

“No, I still had some race in me”.

“Well, what then? Did you not win?”

“I won over a million dollars for my owner”.

“Well, what was it? Bad treatment?”

“Oh no”, the dog said. “They treated us royally when we were racing.”

“Did you get crippled?”

“No.”

“Then why” I pressed. “Why?”

The dog answered, “I quit.”

“You quit?”

“Yes,” he said. “I quit.”

“Why did you quit?”

“I just quit because after all that running and running and running, I found out that the rabbit I was chasing wasn’t even real.”

How many times have we gone around and around the track, chasing the false rabbit of success, only to discover that the real rabbit was under our nose, waiting to be discovered all along?

Quotes to note and remember:

When confronted with multiple solutions to a problem, choose the simplest one.

It was the triumph of hope over experience.

What the wise man does in the beginning, the fool does in the end. There is three i’s in every cycle: first the innovator, then the imitator, and finally the idiot.

In the 1930s the annual return on the S&P500 averaged 0.0 percent.

Two and a half thousand years ago, the Greek philosopher Protagoras told us that “man is measure of all things”. Today, I fear, we are becoming a society in which “things are the measure of the man.”

No comments:

Post a Comment