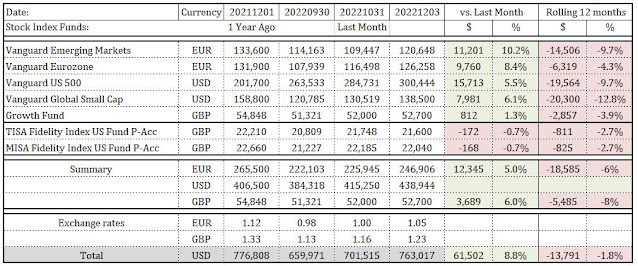

↑ Emerging Markets Stock Index Fund is up by $11,201 or +10.2%

↑ Eurozone Stock Index Fund is up by $9,760 or +8.4%

↑ US 500 Stock Index Fund is up by $15,713 or +5.5%

↑ Global Small Cap Index is up by $7,981 or +6.1%

↑ Growth fund is up 812 or +1.3%

↑ EUR is up to USD by 5.0%, so for my portfolio its $12,345

↑ GBP is down to USD by 6.0%, so for my portfolio its $61,502

Grand total gains: $61,502 USD

|

| Financial Independence November 2022 update |

Trade is also

significantly crippled – imports out of the EU are being reduced - means more

layoffs will come soon, which turns into vicious cycle of less consumption and recession. The USA (entered

recession in summer 2022)., the UK (GDP shrank for three consecutive quarters) and

EU are already in the recession. Recession

is two consecutive quarters of negative gross domestic product (GDP).

The private consumption will be hit hard and fast. For the stocks it will mean decline 5-10% in nominal terms and 15-20% inflation adjusted.

I wish I can go all cash now, but I will be unable to re-enter my funds, as opening threshold had been increased to $1 million per fund. I am planning to stay calm and refrain from any changes.

No comments:

Post a Comment