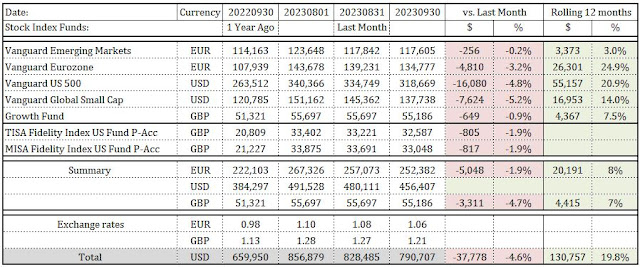

↓ Emerging Markets Stock Index Fund is down by $256 or -0.2%

↓ Eurozone Stock Index Fund is down by $4,810 or -3.2%

↓ US 500 Stock Index Fund is down by $16,080 or -4.8%

↓ Global Small Cap is down by $7,624 or -5.2%

↓ Growth fund is down by $649 or -0.9%

↓ EUR to USD is down by 1.9% for my portfolio its $5,048

↓ GBP to USD is down by 4.7% for my portfolio its $3,311

Total losses: $37,778

Observations:

Long term inflationary pressures are here to stay, at least in the next 3-5 years. In the UK and in the US the governments immediately turned to statistics to manipulate the data. They went back to past and calculated average inflation until today to demonstrate the central bank effectiveness. So, if in the past inflation undershoot the policy, they calculate the time frame between 2003 to 2033 to estimate inflation vs. policy. You cannot make it up!

In the past during the recessions, central banks loosen quickly and sharply, in inflationary booms they were reluctant to respond quickly. This will continue, so inflation will be higher that two percent target.

In the mean time over half of a million people in the UK withdrew 4 bn pounds from their taxable pension accounts to cope with the inflation just between April and June. This is 17% higher withdrawal rate than in 2022.

Fun Fact: State pension in the UK is around $13,000 a year. The government predicts that half of the people retiring in 2060s will live on less than $28,000 year (taxable pension) or $2,000 a months after taxes.

No comments:

Post a Comment