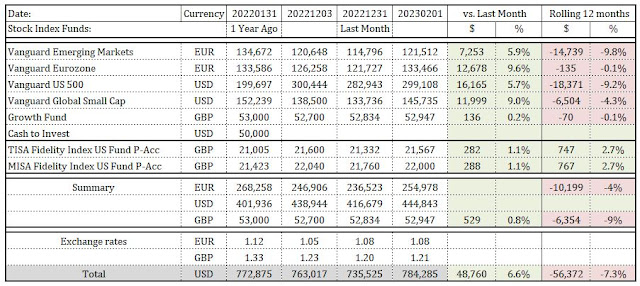

↑ Emerging Markets Stock Index Fund is up by $7,253 or +5.9%

↑ Eurozone Stock Index Fund is up by $12,678 or +9.6%

↑ US 500 Stock Index Fund is up by $16,165 or +5.7%

↑ Global Small Cap Index is up by $11,999 or +9.0%

↑ Growth fund is up $136 USD or +0.2%

↑ GBP is up to USD by 0.8%, so for my portfolio its $529

Grand total gains: $48,760 USD

More and more companies in the west investing in the share buybacks. Advisers say this like capital expenditures, when companies’ directors think that the stock is cheap. Frequently this is done to increase the stock price, as the directors’ salary linked to total shareholder return. So, they doing it to get more money in their own pocket. This is the laziest and risk-free solution, as no need to seek profitable investment ideas. In the UK its 55bn pounds a year. In the past buybacks were only done to reflect exceptional, rather than sustainable profits.

Making the buybacks routine is hardly a resounding show faith in the company’s long-term prospects. In the mean time in the UK investors withdrawn over 50bn pounds in 2022. The UK is definitely been unloved be global investors with the outlook for the UK consumer looks bleak.

Some of the withdrawn money were used for lump-sum mortgage over payments. In 2021 over payments were 1.7bn pounds a month but in 2022 those were increased to 2.4bn pounds a month. This reflects the investors views that economy will perform worse than current mortgage interest rates (7% mortgage variable rate in the UK).

Fun fact: While western european newspapers, website and other mass media sources touting how great their stocks are, you need to look at what pension funds are actually doing. Defined benefit pension schemes invest less than 3 per cent of their assets in the UK, compared with nearly half in 2000. This story is about performance and City greed.

Further on the UK now removed cap on the “performance fees” that protect the savers in the defined contributions schemes, opening the door to the predators to raid the fragmented small pension pots.

Even the local government pension schemes investing 40 percent in overseas equities and less then 20 into the UK.

No comments:

Post a Comment