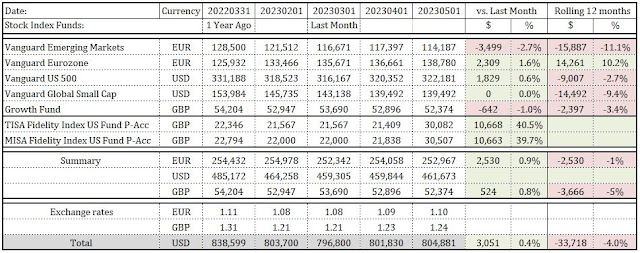

↑ Eurozone Stock Index Fund is up by $2,309 or +1.6%

↑ US 500 Stock Index Fund is up by $1,829 or +0.6%

↑ EUR to USD is up by 0.9% for my portfolio its $2,503

↑ GBP is up to USD by 0.8% for my portfolio its $524

Total gains: $7,191 USD

↓ Emerging Markets Stock Index Fund is down by $3,499 or -2.7%

↓ Growth fund is down by $642 USD or -1.0%

Total losses: $4,141

Observations:

Millennials are (born between 1981 and 1997) largely behind previous generations on home ownership and Zoomers generation (1997 – 2012) will be even worse off. In 2005 average mortgage term for a first time buyer was 25.8 years, today its over 30 years. This means that more money paid as interest, leaving less for pension savings or any other spending.

I added maximum allowed sum to kids’ tax-free college funds ($11K USD each). The tax year in the UK ended on April 5th and any contributions should happened before that. Its tax free only for any capital gains or interest earned but the contributions don’t have any tax breaks. At the time a child is 18 years old the fund is available and converted to an adult.

Individual Savings Account (ISA). I don’t count the money in their funds as part of the nest egg (you can’t get them out once the money is in). I have previously written how the consistent Junior ISA contributions enable to avoid inheritance tax and cement the inequality in the UK. If I will have money to get them through the university the kids can use the funds money as down payment to get themselves on a property ladder.

My emerging markets was down as its focuses on financials and IT more than on consumer staples products. The Eurozone is focuses on european oil and gas companies (Total, Eni, Repsol and their suppliers) + luxury companies (LVMH Moet Hennessy Louis Vuitton SE and others). This explains where former lost value and latter is grew somewhat.

Fun fact: On December 31, 1999 British Financial Times Stock Exchange (FTSE) 100 index closed at 6,930 .. it did not pass 7,000 until March 2015. Today it stands at 7,778. For the past 22 years staggering 12% increase…0.5% a year only Japan falls behind. S&P500 grew 180% in the same period 0r 5% a year. Even UK pension funds owned just 2% of the UK market down from 32% in 1992. This is partially explained that majority of Brits counting on state pension, rather than privately owned.

No comments:

Post a Comment