↑ Emerging Markets Stock Index Fund is up by $2,090 or +1.7%

↑ US 500 Stock Index Fund is up by $1,188 or +0.4%

↑ Growth fund is down by $1,737 USD or +2.7%

Total gains: $5,016

↑ US 500 Stock Index Fund is up by $1,188 or +0.4%

↑ Growth fund is down by $1,737 USD or +2.7%

Total gains: $5,016

↓ Eurozone Stock Index Fund is down by $3,354 or -2.2%

↓ Global Small Cap is down by $3,927 or 2.8%

↓ EUR to USD is down by 2.7% for my portfolio its $7,555

Total losses: $14,835

Observations:

In general, population in the “west” has been convinced by mass media that getting interest on their bank deposits below official inflation rate (the USA 2023 inflation – 4.9%, actual – 8% , the UK inflation – 8.7%, actual – 11%) is normal. The only possible hand brake on the inflation is that a lot of the people will need to re-mortgage, this will come at higher interest rates. As the result people will pay more to the banks and have less money to spend on anything else. On in seven people in the UK (10 million) are struggling to meet bills and credit payments.

This madness is now spreading to equities, with companies’ paying dividends below inflation:

- British Petroleum (BP) - 4.6%

- Chevron (CVX) - 3.95%

- Exxon Mobil (XOM) – 3.5%

- TotalEnergies (TTE) - 3.8%

- Shell (Shel) – 4.2%

In the mean time you can get 4.5% interest on the savings in the UK with all your capital insured by the government and 5.2 % (Forbright, for example) in the USA. Why would anybody invest in the stocks which barely grow and don’t pay dividends even above the official inflation? Both investment returns will be negative in real terms but savings account is almost no risk.

There is still further differentiators. Western european shareholders support spending on low-profit clean energy projects, while the US shareholders wouldn’t. The differentiation are tax brakes (aka incentives). This explains while Exxon profits in 2022 where $56 bn – far outpacing Shell and BP.

Additionally, Western Europe oil companies (BP, Shell and TotalEnergies) heavily rely on trading for their revenue. This is considered a speculation with unpredictable outcome.

According to estimates Shell made $16.6 bn from trading in earnings ($42.3 bn total), BP $11.5 bn ($28 bn in total), TotalEnergies $8.4 bn ($36.2 in total). Shell moves 14 mn barrels on oil equivalent a day (produces 2 mn) , BP – about 11 mn boepd (produces 1.1 mn boepd).

One of the reasons why the dividends don’t increase, that the companies’ management lacks of investment ideas. Stocks buy back in 2022: BP - $11.7bn, Chevron - $8.8bn, ExxonMobil - $15bn, TotalEnergies - $8bn and Shell $ 18.4bn. The CEOs are rewarded for total return on shares (change in price + dividends). For the energy companies its not a smart idea, as they are undermining future growth and any oil price increase will be short lived.

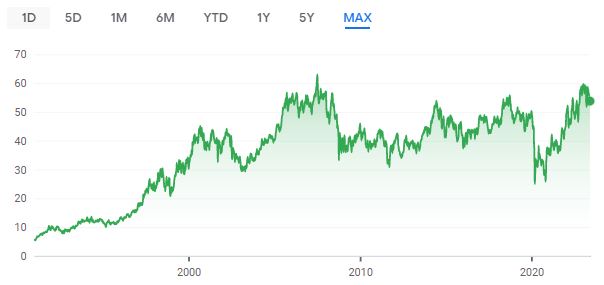

Look at the Shell share price, for example :

Figure 2. Shell oil company share price hasn’t moved in the past 25 years even with the inflation.

Figure 3.

TotalEnergies share price over the years

This explains that there are a lot of studies from big and small that 60/40 splits (60 per cent of the portfolio in equities and the remainder in bonds) will not work in the current anti-free market environment.

Fun Fact: Average person spends more time buying a car than managing their investments, however confidence doesn’t decline in line with ability.

Equities (shares/stocks) are usually an asset class suited to those with a commensurate risk tolerance and sufficiently long time frame. So short-term returns below inflation are nothing extraordinary, with the expectation being that, in the long term, total return (capital growth + dividends) *should* end up exceeding inflation and providing a decent real return. And that higher risk (volatility) investments (eg equities and property) provide a higher total real return over the medium to long term that is expected for bonds, and the lowest risk/lowest expected real return (often approx. 0% in real terms, and negative after taxation) is fixed interest/cash.

ReplyDeleteThat being said, if you want a low risk inflation-protected investment, perhaps inflation-linked bonds (or an index funds that invests in a mix of available inflation-linked bonds, such as Vanguard Australian Inflation-Linked Bond Index Fund (or the UK, EU or US equivalent) would be of interest?

ps. Having a small percentage (eg 2%-5%) in bullion seems to also provide some benefit to one's overall portfolio asset allocation. But, providing no interest/dividends and often having storage/insurance costs and, sometimes (eg. coins) a large 'premium' over spot bullion prices, it generally isn't a good idea to have too much allocated to this asset class (unless you are a 'gold bug' and hope/expect your investment time frame will happen to coincide with one of those periods when bullion as performed really well, rather than one of those periods (often lasting decades) when it has done really badly. In the really long term (eg. 100+ years, which is probably longer than most investors are worried about) bullion tends to just keep pace with inflation. But being relatively uncorrelated with other asset classes, it doesn't provide significant diversification benefits to an investment portfolio (in small doses).

Dear Enoughwealth, Thank you for stopping by and your comment. Your argument is solid and I agree with you. As you said: "an asset class suited to those with a commensurate risk tolerance and sufficiently long time frame". This is why I provided the share price over 20 year+ horizon. Up to ten years ago there has been some correlation between the equities I mentioned and S&P500, since than they are going in opposite direction. For the past 5 years S&P500 went up by 50% (from July 18), while Shell shares 16% down, Total 11%, Chevron and Exxon up by 24% but still under performing. If you look at past 10 years the picture is more bleaker for the energy companies. Despite of the solid oil and gas prices they are paying less than 4% in dividends.

ReplyDeleteI entirely agree with you on bullion but at $1,919 per ounce its almost historical high (2,449 in April 2011). This is something on my radar. As I am getting older the retirement is no longer a distant future but somewhere in 20 years range or sooner.